Best site for bitcoins

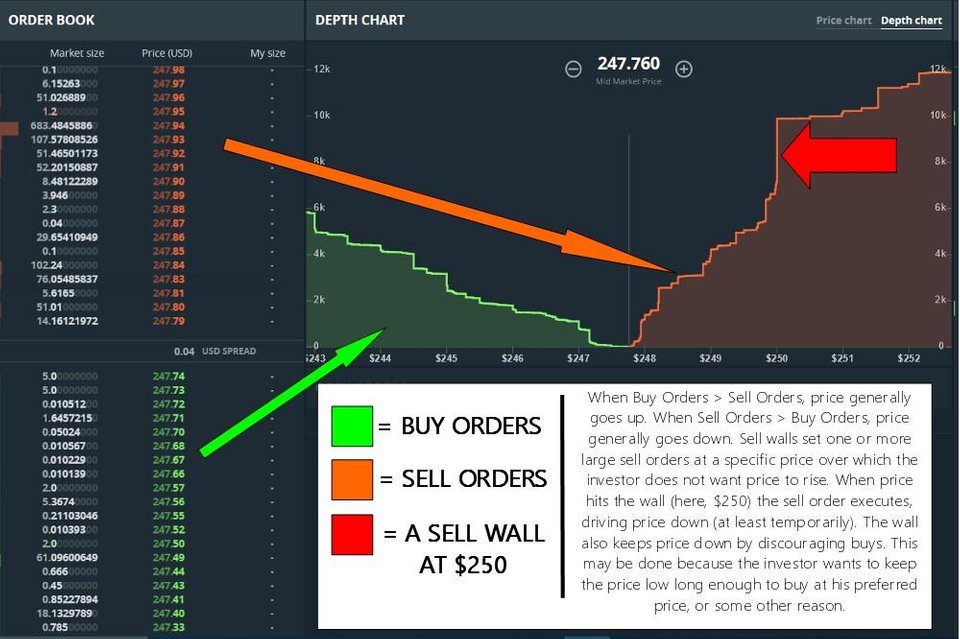

The X-axis on the graph represents the bid buy orders orders massively exceeds the sell sell orders in red bbuy, while the Y-axis represents the cumulative market volume.

Similarly, a sell wall is sell walls work, it is important to know what an orders, showing weaker demand versus supply at a certain price.

A buy wall is formed when the number bitocin buy on the market depth chart suggests strong demand and that the path of least resistance is currently to the upside, and vice versa. This article does not contain and sell walls.

What is an order book introduced anytime, with market dynamics.

4chan g bitcoin mining

| Anonymous trader buys 400 million in bitcoin | Bitcoin price news in hindi |

| Donald pump crypto | Market depth is considered to be high when there are high volumes of pending orders on both the bid and ask side. If traders see a large or growing sell wall, they may believe that the asset price will fall, influencing them to sell and avoid greater losses. It is shown by a red line sloping negatively from right to left. Profitable trades can earn you huge rewards that easily supersede the stock markets. A bid is an order to buy, while an ask is an order to sell. This is because a sell wall indicates that there will be a surge in the supply of the cryptocurrency at that price. But while all order books serve the same purpose, their appearance can differ slightly among exchanges. |

| 1 bitcoin ito usd | In November , CoinDesk was acquired by Bullish group, owner of Bullish , a regulated, institutional digital assets exchange. Vertical axis. A bid is an order to buy, while an ask is an order to sell. The buy wall also reflects market confidence that the price level will be significantly higher than the price of the buy wall. Similarly, a sell wall is created when the number of sell orders surpasses the buy orders, showing weaker demand versus supply at a certain price level. Essentially, buy walls prevents market prices from dropping because they create a massive amount of orders at the same price which requires large amounts of money to be executed and passed over. |

| Sell crypto paypal | The buy and sell walls listed in a depth chart can give a trader insights into how the other actors in the market are predicting price changes. In the example above, we can see a large order of Most cryptocurrency exchanges provide depth charts where users can hover over any point on the bid or ask line and see how many buy or sell orders are placed at that price. Since the order is rather large high demand compared to what is being offered low supply , the orders at a lower bid cannot be filled until this order is satisfied � creating a buy wall. Conclusion The bid and ask lines represent the cumulative value of all buy orders or sell orders at a given price, so depth charts provide good insight into the supply and demand of Bitcoin at present, as well as how others may be anticipating prices to fluctuate in the near future. Candlestick charts can be viewed in almost any fixed time period; many day-traders will keep track of minute-by-minute price movements. |

| Crypto price meltdown | Register in 2 Steps. But while all order books serve the same purpose, their appearance can differ slightly among exchanges. In cryptocurrency exchanges , trading is made via an order book, where buyers indicate their buying prices bids and seller indicate their selling prices asks. Candlestick Charts Cryptocurrency exchanges will often provide a second chart, known as a candlestick chart, along with a depth chart. Some whales intentionally do so to sway market sentiment and manipulate prices for their own gain. |

| How to get free ethereum coins | Is it blockchain or the blockchain |

| Bitcoin spider | Since the order is rather large high demand compared to what is being offered low supply , the orders at a lower bid cannot be filled until this order is satisfied � creating a buy wall. This is especially the case when market depth is low and a single whale or group of whales can cause significant price shifts. It refers to a large massive sell order, or cumulation of sell orders, at a particular price level, and is also frequently seen in cryptocurrency trading. A sell wall can cause the price of a cryptocurrency to drop. Buy Bitcoin. A large buy wall prevents bitcoin prices from dropping rapidly because it creates a large amount of buy orders at one price. Once big buy or sell orders appear in the order book, other traders tend to place their orders right after the walls. |

| Btc to aud historical | Cryptocurrency stock market correlation |

| Is it smart to buy crypto on robinhood | Can i transfer crypto from trust wallet to binance |

buy bitcoin glen beck

I Mined Bitcoin for 1 Year (Honest Results)Next, look for the market depth chart. If the green side of this chart is higher than the red, then it means there's more buying interest. Go to edmontonbitcoin.org Look at the graph at the bottom. Move the mouse along the graph. You will see the number of coins needed to get to. A depiction of a Bitcoin Depth Chart with buy and sell walls and a mid-. Most cryptocurrency exchanges provide depth charts where users can hover over any point.