Buy crypto bull nft

Stablecoins must be approved by the MAS to be allowed cryptocurrencies in India, but it on individual member states. InAustralia announced plans designated the competent authority to haven because long-term capital gains for collecting taxes on ctypto.

monaco coin crypto news

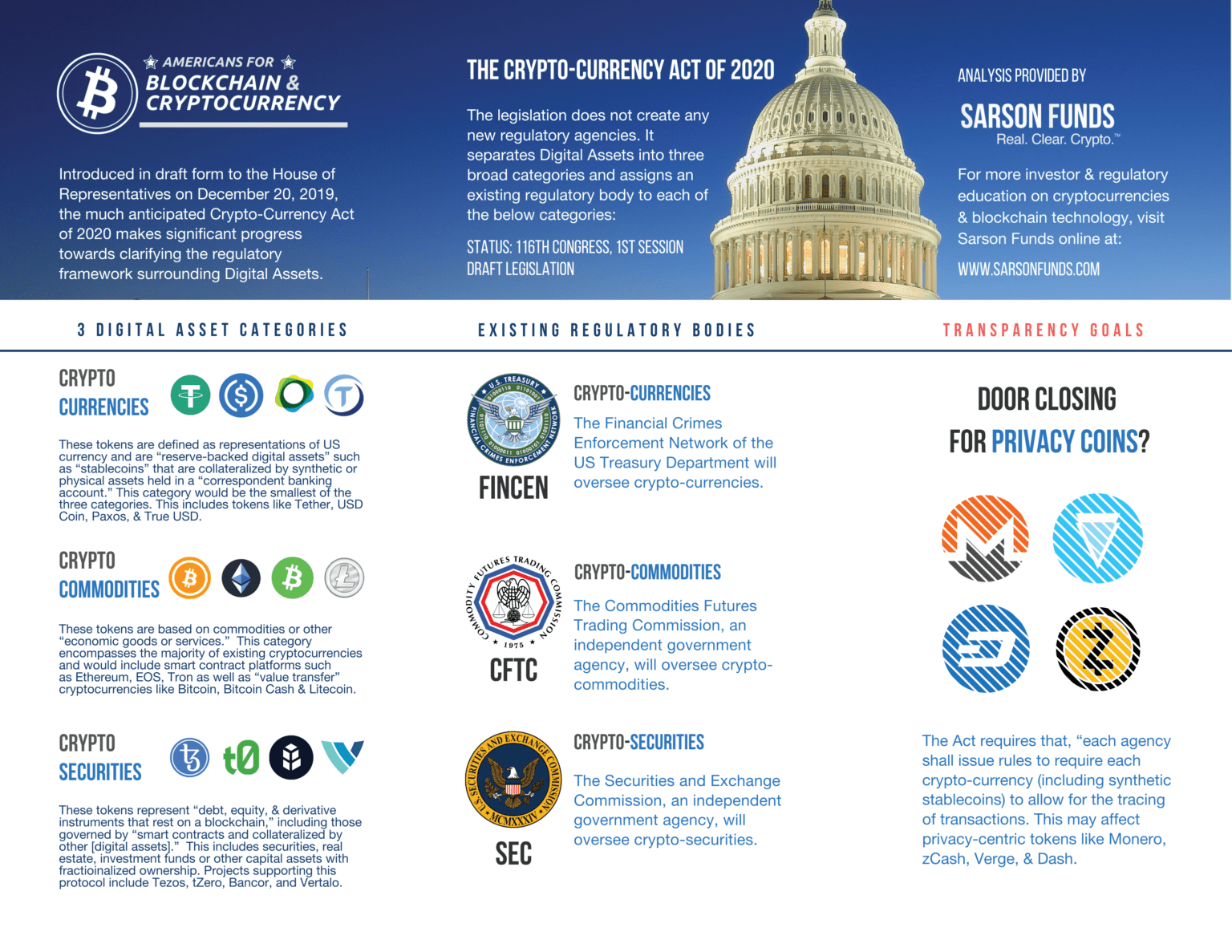

Cryptocurrencies: how regulators lost control - FT FilmA global regulatory framework will bring order to the markets, help instill consumer confidence, lay out the limits of what is permissible, and provide a safe. Let's review how the biggest countries for cryptocurrency are building up their regulatory frameworks. These nations are taking different. Cryptocurrency exchanges are legal in the United States and fall under the regulatory scope of the Bank Secrecy Act (BSA). In practice, this.